Insights

2023 Currency outlook

Share this article

Inflation dominated the FX markets in 2022, as any stabilization of supply chain disruptions from COVID was swiftly overwhelmed by the Russia-Ukraine crisis, causing energy resource bottlenecks across the world. Building upon its strong legs from 2021, US dollar outperformed all of its G10 counterparts as the hawkish Fed led central bank policy globally. With policy divergence amid rising interest rates, FX volatility rebounded higher through Q3, at which point both US dollar and FX volatility reversed as the market’s appetite for risk re-emerged in Q4.

Inflation contagion

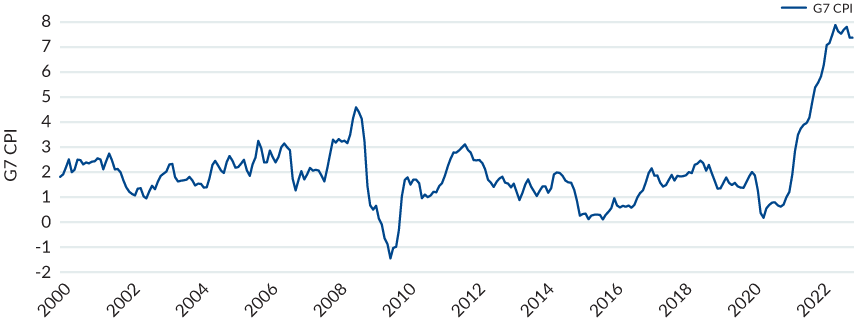

The inflation debate, structural vs. transitory, was emphatically answered, as persistently high CPI numbers spread globally. The lingering effects of the pandemic – disrupted supply chains around the world leading to shortages, backlogs, and delays – ushered in 2022, as the world grappled with the Omicron variant. Any possible lull in rising inflation was unceremoniously dashed when Russia invaded Ukraine, kickstarting a surge in energy prices, as the region’s dependency on the Russian gas supply was exposed. Developed market inflation reached multi-decade highs (chart 1) as soaring prices became a global phenomenon.

CHART 1: DEVELOPED MARKET INFLATION (2000 – 2022)

Source: Bloomberg, OECD. Past performance is not necessarily indicative of future results. Actual results may materially differ.

The information contained herein is intended for institutional clients, Qualified Eligible Persons, Eligible Contract Participants, or the equivalent classification in the recipient’s jurisdiction, and is for informational purposes only. Nothing contained herein constitutes an offer to sell an interest in any Mesirow investment vehicle. It should not be assumed that any trading strategy incorporated herein will be profitable or will equal past performance. Please see the disclaimer at the end of the materials for important additional information.

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters