Insights

4Q2023 Currency Commentary

Share this article

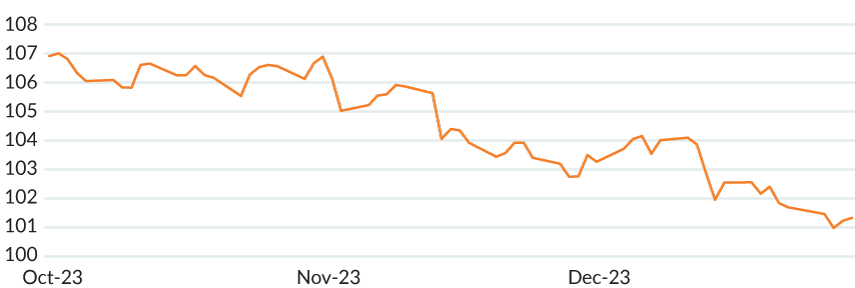

US dollar underperforms all G10 currencies

US dollar underperformed all constituents of the G10 in the fourth quarter on a dovish Fed along with relatively soft inflation prints. While interest rates were left unchanged at the FOMC meeting in December, the dot projection update indicated 75bps of rate cuts next year as Powell noted discussions around the timing and magnitude of the cuts.

While subsequent Fed speakers attempted to push back on the market’s rate cut expectations, dovish revisions to Q3 GDP and soft PCE inflation numbers continued the weak US dollar story into the end of the year.

FIGURE 1: DXY – 4Q2023

Source: Bloomberg

EUR | Euro depreciated against most developed currencies in Q4, trailing G10 currencies save the weaker US and Canadian dollars. The ECB left rates on hold at 4.5% and moved the timing of the end of the PEPP reinvestments forward to the end of 2024, while emphasizing that the council did not discuss rate cuts at all and that market expectations of rate cuts were premature. The most recent Eurozone flash PMIs and the German IFO surveys surprised lower, with business expectations worsening.

GBP | Sterling landed in the middle of the G10 this quarter, outpacing the US and Canadian dollars while slightly outperforming Euro. Recent data was primarily dovish, with employment falling 13K, pay growth decelerating at a faster pace than expected, core inflation dropping to 5.1% YoY, and GDP contracting by -0.3% MoM in October. The BoE kept rates at 5.25%, while promoting a hawkish bias through its minutes relative to the dovish Fed.

JPY | Yen landed in the upper half of the G10, trailing only Swiss franc and Swedish krona. Despite the BOJ standing pat on rates and delivering dovish commentary, market assumptions tilted towards a policy change signaled by Governor Ueda’s comments that policy management would get more challenging in 2024. The BoJ redefined 1.0% as a loose "upper bound" rather than a rigid cap on their yield control. Short covering into year-end helped support Yen following a weak year overall.

AUD | Australian dollar was a middling performer in the G10 in the fourth quarter. The RBA hiked rates by 25bps to 4.35% in November, although their guidance reflected a more data driven approach going forward. Inflation printed at 5.4% YoY for Q3, a bit higher than consensus. Australian dollar found support late in the year through improved risk sentiment as risk assets gained in December to end the year.

CAD | Canadian dollar weakened, only outperforming the weaker US dollar in the G10. The BoC held rates steady at its policy meetings, noting that the economy was no longer in excess demand and thus reducing inflationary pressures. Annual inflation came in unchanged at 3.1% YoY for November, although consensus was lower at 2.9%. BoC Governor Macklem reiterated that it was still too early to consider cutting rates.

CHF | Swiss franc outperformed the rest of the G10, ending the year as the highest performer in 2023. The SNB kept rates unchanged at 1.75% throughout the quarter, noting that inflation will continue to be monitored to ensure price stability. Inflation slowed to 1.4% YoY in November, although higher electricity prices and rents are risks for increasing prints in the future.

EM | Emerging market currencies gained overall as the MSCI Emerging Markets Currency Index appreciated over 4% this quarter. With US dollar performing poorly over the quarter, emerging market currencies were able to gain ground as the outlook for lower interest rates increased risk appetite.

TABLE 1: USD-BASED AS OF DECEMBER 31, 2023

| FX Rate | Change 3M % | Change YTD % | ||

| EUR-USD | 1.10465 | 4.34% | 3.50% | |

| GBP-USD | 1.2748 | 4.44% | 5.98% | |

| USD-JPY | 140.98 | 5.85% | -6.41% | |

| AUD-USD | 0.68235 | 5.73% | 0.62% | |

| USD-CAD | 1.3186 | 2.53% | 2.76% | |

| USD-CHF | 0.84165 | 8.69% | 9.93% | |

| Source: WM/Reuters | ||||

Source: WM/Reuters

Currency for return

Currency Alpha

Mesirow Currency Management’s (MCM) Currency Alpha strategies all suffered losses this quarter. The Emerging Markets Currency Alpha and the Systematic Macro strategy end the year with positive performance, while MCM’s Extended Markets Currency Alpha and Asian Markets Currency Alpha strategy close out the year in the red.

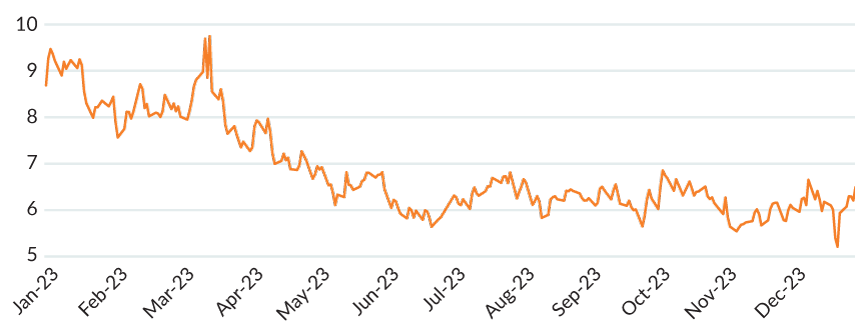

Our proprietary measure of global currency volatility, our GVI1 remained stable (overall) during the fourth quarter and reached a low for the year at the end of December (Figure 2).

FIGURE 2: MCM'S GLOBAL VOLATILITY INDICATOR: JANUARY 2023 - DECEMBER 31, 2023

Source: Mesirow

Our Economic Surprise model, found in our Technical suite of models had overall positive performance this quarter across the strategies, but it wasn’t enough to bolster the losses the Technical strategy experienced in Q4.

As the US dollar weakened in the fourth quarter, our long USD positions, notably against the Japanese Yen and the Thai Baht performed poorly, however, our long Australian Dollar vs. the USD and our short US dollar vs. the Swedish Krona and the Mexican Peso delivered profits and helped mitigate negative performance.

Intelligent Multi-Strategy Currency Factor

MCM’s Intelligent Multi-Strategy Currency Factor fell -2.12% (gross) this quarter as a significantly weaker US dollar penalized long USD positioning, most notably against a strong Swiss franc. All three sleeves – Carry, Value, and Momentum – were penalized on USD weakness in Q4, with Value detracting the least and Momentum giving back the most.

The strategy ends the year down -2.04% (gross).

Latest MCM viewpoints

Hedge Share Class Investors Grapple with Shorter (T+1) Security Settlement Cycle

Nations are rushing to launch CBDCs. Will the U.S. be a leader or a laggard in the digital currency race?

Contact us

To learn more about Mesirow Currency Management's custom currency solutions, please contact Joe Hoffman, CEO Currency Management at joseph.hoffman@mesirow.com.

Explore currency solutions

Passive and Dynamic Risk Management

Customized solutions to manage unrewarded currency risk in international portfolios.

Currency for Return

Strategies that aim to profit from short and medium-term moves in the currency market.

Fiduciary FX

Trading solution for asset managers and owners with focus on reducing transaction costs, improving transparency and enhancing efficiency.

1. The GVI is an internal proprietary model utilizing one month at-the-money (ATM) volatility for G10 currencies, including crosses plus BIS liquidity report weightings.

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters