CTL and Structured Debt

We offer a unique suite of services including both senior and subordinate debt products and access to our firm’s balance sheet in order to enhance execution certainty at various levels of the capital stack.

For institutional investors

8

Consecutive years with a top 10 ranking in domestic private placements**

$16B+

In CTL and structured debt products transaction volume*

80+

Fixed income professionals on our Institutional Sales and Trading team*

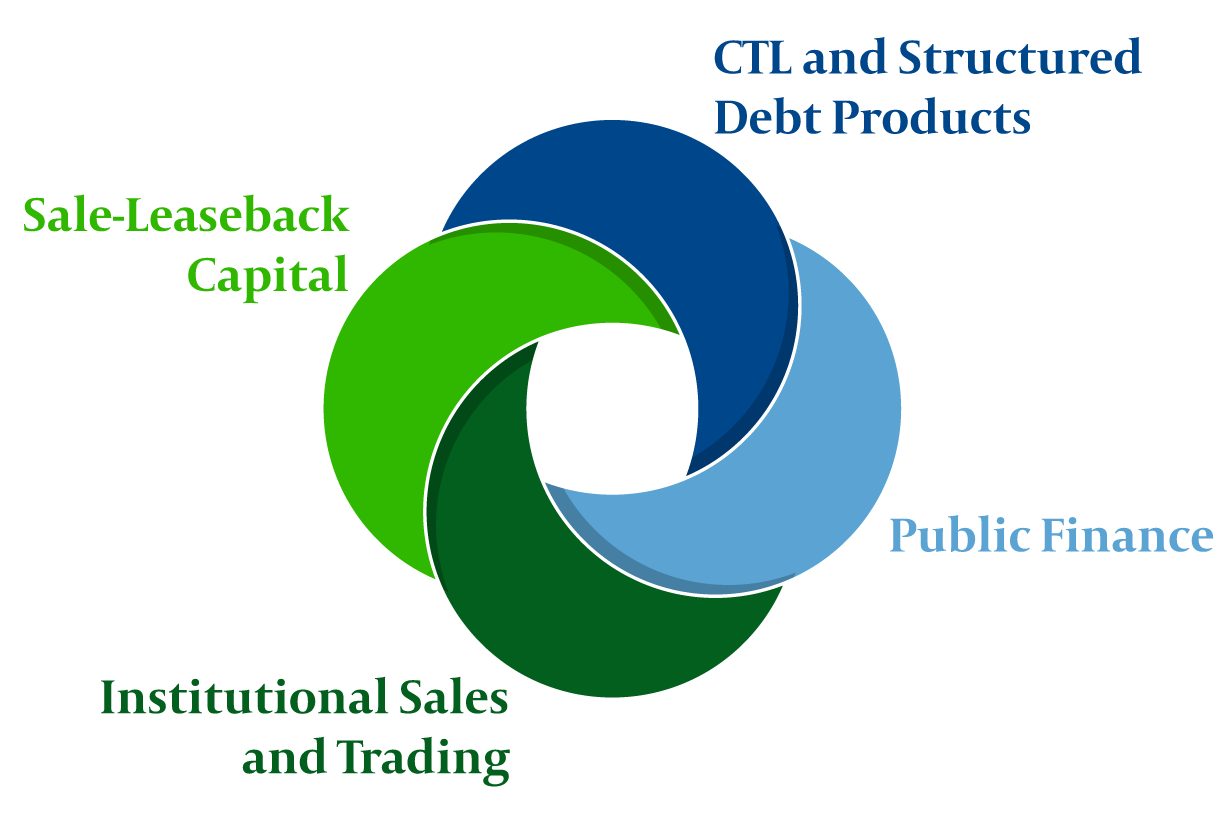

Capital Markets

"We are providing essential capital for all sectors of the economy. We take that very seriously here at Mesirow."

Nat Sager, Senior Managing Director

Our clients access...

differentiated, integrated capabilities from across Mesirow Capital Markets, in addition to potential access to the firm’s balance sheet.

Solutions

Credit tenant lease

- Investment-grade

- High yield

Bifurcated ground lease notes

Synthetic securities

- Transaction "re-packs"

- Rated and non-rated

Equity structuring | Placement

Tax credit equity

Tax increment financing (TIF)

Tenant improvement and equipment lease

Extended amortization | Residual notes

- B Notes

- Zero coupon

- Partial coupon

- A2 pari-passu securities

- Mezzanine debt / equity

- Rated and non-rated notes

Insights

Senior leaders

Explore

*Data as of 3.31.2024. | **Private Placement Monitor League Tables 2015-2022.

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters