Institutional Sales and Trading

We provide sophisticated market analysis, individualized service, customized investment strategies and market liquidity to serve the unique needs of your institution.

For institutional investors

$125B+

Annual secondary trading volume - one of the nation’s most active desks**

80+

Traders, sales professionals and analysts aligned by fixed income sector*

$395M

Average volume of secondary trading positions*

Through customized service...

proprietary research, longstanding relationships and steady growth, we have established a highly-regarded reputation in the industry. Our clients benefit from relevant ideas and insights along with the expertise and willingness to commit capital through solutions that offer:

Our clients access...

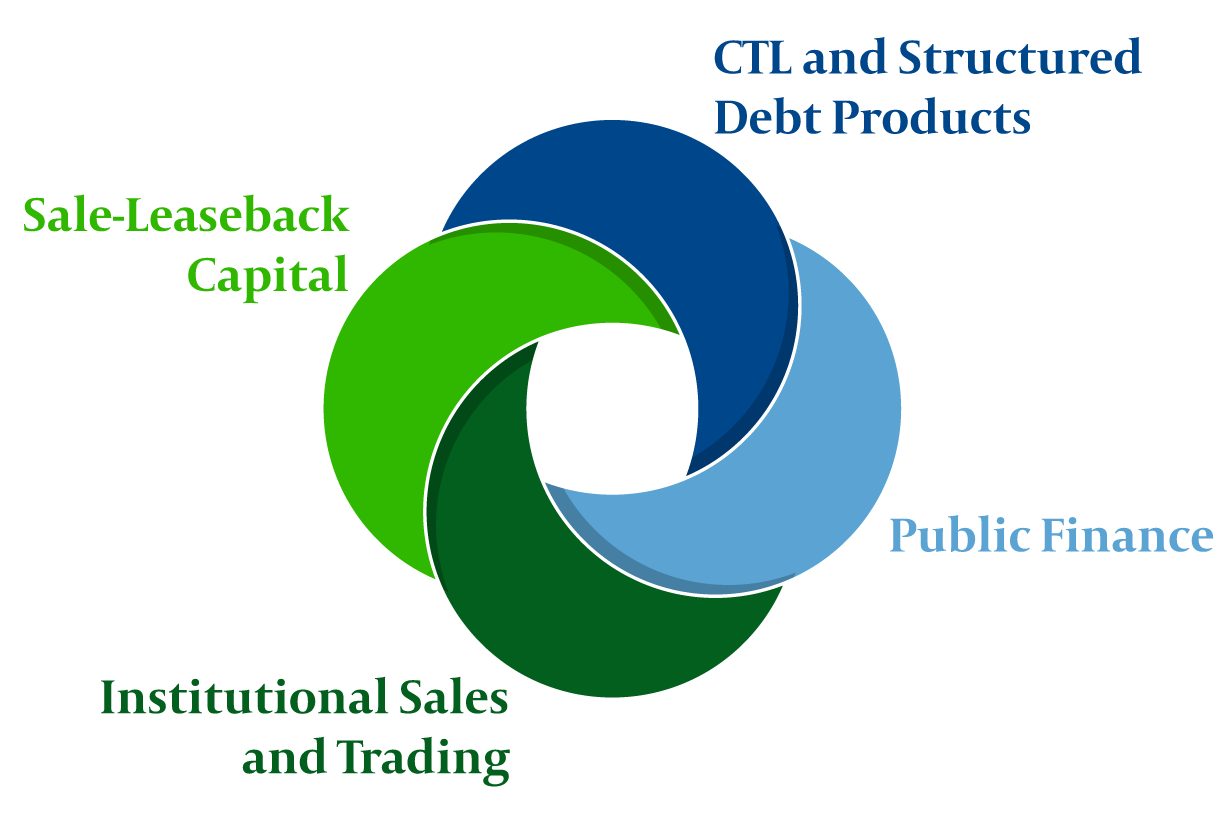

differentiated, integrated capabilities from across Mesirow Capital Markets, in addition to potential access to the firm’s balance sheet.

Solutions

With major trading desks located across the US, we focus on the trading and distribution of:

Municipals

Three trading desks focused on 1) Institutional investment-grade blocks, 2) Separately-managed accounts and 3) Short-duration securities, lower invest grade and high yield/distressed securities

Mortgages

Agency and non-agency residential mortgage-backed securities, dedicated trading for commercial mortgage-backed securities from high-grade to distressed credit

Rates/Agencies

Actively involved in all interest rate-based securities. As a top underwriter of Agency debt, we offer a variety of structures and maturities.

Access diverse, specialized investment products for institutions, insurance companies, banks, money managers, mutual funds and pension funds.

We focus on the proprietary trading and distribution of:

- Agency origination capabilities (averaging $6B annually)

- Asset-backed securities (subordinate and senior)

- Collateralized mortgage obligations

- Commercial mortgage-backed securities

- Convertible bonds

- Corporate bonds

- Credit tenant lease financing, loan structuring and private placements

- High yield securities

- Mortgage-backed securities

- Municipal bonds (taxable and tax-exempt)

- Preferred stocks

- Tender option bonds (TOBs)

- Treasury Inflation Protected Securities (TIPs)

- US government and agency securities

Benefit from a deep team of industry-leading credit specialists focused on macro-municipal trends and investment grade credit:

- Airlines / airports

- Continuing care retirement communities (CCRC)

- Distressed / bankrupt securities, including workout and restructuring

- Distressed local governments

- General governments

- Health care

- Higher education and miscellaneous nonprofit entities

- Housing financing (single and multi-family)

- Industrial development corporate-backed

- Land development financing

- Prepaid gas

- Puerto Rico and other US territories

- Special tax-backed and lease-backed securities

- Tobacco

- Toll roads

- Transportation and transit agencies

- Utilities, power, energy

Insights

Stay current...

with news and commentary on sectors and industries from our senior professionals.

Senior leaders

Explore

*Data as of 3.31.2024.

**Data as of 3.31.2024 (updated annually).