Public Finance

We provide innovative debt financing solutions to a diverse set of public clients — government agencies, non-profits and other tax-exempt and taxable borrowers — as they fund important capital and infrastructure projects.

For institutional investors

Our clients are offered...

unbiased service with access to both regional- and sector-based approaches. Regional bankers in six US urban centers support clients’ day-to-day needs and, as needed, sector specialists provide targeted expertise.

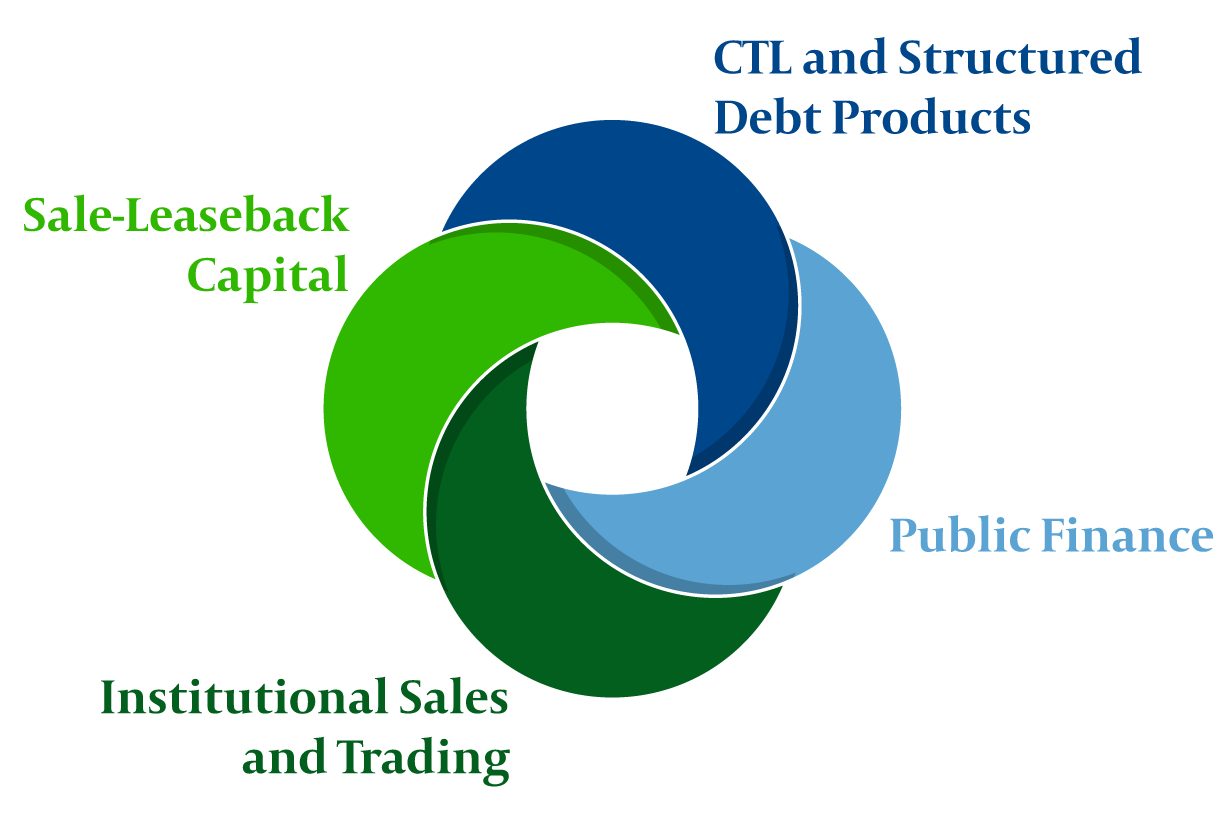

Our clients also benefit from differentiated, integrated capabilities from across Mesirow Capital Markets.

Solutions

We work side-by-side with clients to develop creative, tailored debt structuring and financial analysis. Our technical acumen enables us to optimize bond sizing for new projects or refunding and restructuring opportunities.

Robust analytics and modeling capabilities for tax-exempt and taxable debt

Emphasis on leveraging the deepest pool of investors across available public and private debt placement alternatives

Focus on lowest cost of capital and greatest flexibility over time

A dual-tracking mindset comparing the approaches of a public offering versus a private placement

Ensuring our clients achieve the most cost-effective borrowing

Holistic support, from the initial planning stages of debt issuance through deal execution

Technical support and industry insight on market best practices

Provider of initial and replacement escrow portfolios

Reinvestment of construction, capitalized interest and acquisition funds

Reserve fund securities

Sectors

General Government

State and local government

Park districts

Transportation

Public transportation

Highways

Airports

Education

School districts

Universities

Utilities

Water and sewer

Electric

Nonprofits

Healthcare

Social service providers

Cultural Institutions

Capital Markets

Swaps

Other derivatives

Insights

Stay current...

with news and commentary on sectors and industries from our senior professionals.