A savvy approach to charitable giving

Share this article

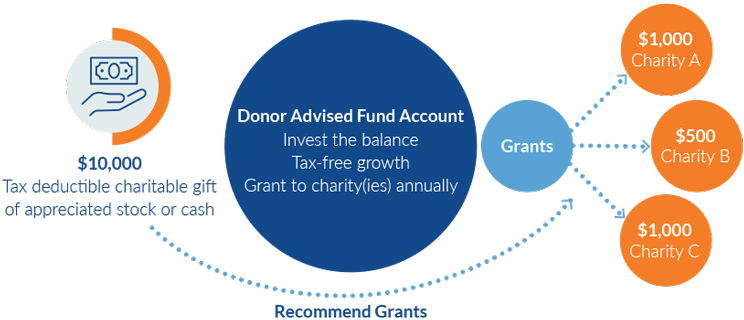

In preparation for tax time, many of our clients look for opportunities to maximize their charitable contributions, especially in a “windfall” year. One way to do this is with a Donor Advised Fund, which allows donors to make a charitable contribution, receive an immediate tax benefit and then recommend grants to charities over time.

One way our clients often make their charitable contributions is by donating to a donor advised fund. Think of this as an easier and less costly alternative to a charitable family foundation.

How a donor advised fund (DAF) works

- You donate either cash or appreciated stock to the donor-advised fund and receive the allowable charitable tax deduction.

- You, with the support of your advisor, control the investments in the donor-advised fund.

- Your investments in the donor advised fund grow tax free.

- You control your donor advised fund account during your lifetime, with named successors to carry on your legacy.

- You recommend which charities you want to provide a grant to.

- You control how much you want to grant out to the charity or charities each year (usually at least 5% of the principal each year).

Additional tax implications

- Give appreciated stock The full value goes to the donor-advised fund. The Fund does not have to pay capital gains on the appreciated stock.

- Give more in a windfall year You can maximize your deduction and then give to charity over time.

- Receive only one charitable deduction notice on the contribution even though the grants are going to multiple charities.

Next steps

The concept is simple and the approach is savvy. That said, this type of donation should be integrated into your overall charitable giving strategy. Discuss this with your wealth advisor to see how best to maximize the benefit of the donation as well as the long term impact on your financial plan.

Published February 2024

https://givingusa.org/wp-content/uploads/2022/06/GivingUSA2022_Infographic.pdf

Connect with an advisor

Mesirow does not provide legal or tax advice. Past performance is not indicative of future results. The views expressed above are as of the date given, may change as market or other conditions change, and may differ from views express by other Mesirow associates. This is not a solicitation to buy or sell the securities mentioned. Do not use this information as the sole basis for investment decisions, it is not intended as advice designed to meet the particular needs of an individual investor. Information herein has been obtained from sources which Mesirow believes to be reliable, we do not guarantee its accuracy and such information may be incomplete and/or condensed. All opinions and estimates included herein are subject to change without notice. This communication may contain privileged and/or confidential information. It is intended solely for the use of the addressee. If you are not the intended recipient, you are strictly prohibited from disclosing, copying, distributing or using any of the information. If you receive this communication in error, please contact the sender immediately and destroy the material in its entirety, whether electronic or hard copy. This material is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security.

Mesirow refers to Mesirow Financial Holdings, Inc. and its divisions, subsidiaries and affiliates. The Mesirow name and logo are registered service marks of Mesirow Financial Holdings, Inc. ©2024, Mesirow Financial Holdings, Inc. All rights reserved. Any opinions expressed are subject to change without notice. Past performance is not indicative of future results. Advisory Fees are described in Mesirow Financial Investment Management, Inc.’s Form ADV Part 2A. Advisory services offered through Mesirow Financial Investment Management, Inc. an SEC registered investment advisor. Securities offered by Mesirow Financial, Inc. member FINRA and SIPC.